22.9M (70%)

Population without access to clean cooking (Source: WHO, 2021)

16

Active clean cooking ventures (Source: CCA)

0

Number of clean cooking RBF (Source: CCA)

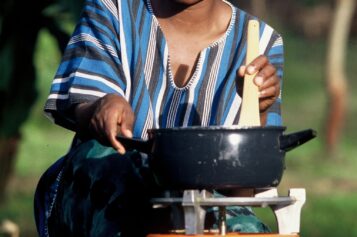

Ghana has a nascent clean cooking industry consisting of a small number of local companies across various technologies. There is a large unmet demand for clean cooking, but access rates have remained flat with around one-in-five having access to clean cooking technologies and fuels.

BURN Manufacturing established a factory in Ghana in 2022; their first factory outside of Kenya. Politically, there is strong support for clean cooking from the office of the Second Lady, Her Excellency, Hajia Samira Bawumia, who is a global ambassador for clean cooking. Ghana is the only country to have hosted two global Clean Cooking Forums.

According to World Bank data, 30.3% of the population had access to clean fuels and technologies for cooking in 2021; broadly similar to the ratio of 21.4% in 2015. In 2021, just 12.2% of the rural population had access to clean cooking fuels, compared with 45.5% of the urban population.

Compared with access to clean cooking fuels and technologies, there is much better access to electricity in Ghana; 86.3% of the population had access in 2021, up from 74% in 2015.

Click ‘Read more’ to explore data from World Bank.

According to the Ghana Consumer Segmentation report (see related resources below), two-fifths of urban households still use charcoal as their primary cooking fuel.

Related Resources

Click ‘Read more’ to explore relevant aspects of Ghana’s Nationally Determined Contributions and other current policies that are relevant to clean cooking.

Nationally Determined Contributions

The Ghanaian NDC outlines a mitigation policy to expand the adoption of market-based cleaner cooking solutions. This policy aims to scale up the adoption of LPG use from 5.5% to 50% in peri-urban and rural households by 2030, as well as increase access and adoption of 2 million efficient cookstoves by the same year. The government also aims to promote modern cooking technologies such as cooking gas. However, despite these objectives to promote clean cookstoves, the mitigation action is unconditional due to a lack of cohesive national policy, strategy, and coordination framework for the cookstoves sector, compounded by inadequate regulation in the cooking sector. The policy on subsidies for LPGs acknowledges a lack of incentives to promote the cooking sector, such as import duties and taxes on technologies and regulation of raw material inputs like scrap metal. Consequently, without any obligations for households to use improved cookstoves or LPGs, there is no guarantee that the objectives will be achieved. However, the PoA could create an enabling environment for these objectives to be accomplished.

Other Relevant Policies

Ghana had a subsidy for LPG from 1990, which was removed in 2013. Whilst the subsidy was operating, the share of primary LPG users increased from 6% (2000) to 19% (2013) and 26% (2018). The impact of the removal of the subsidy was a net price increase of 50% for LPG and an increase of 20% for diesel. In rural areas, the use of firewood for cooking increased by up to 3%. In urban areas, the use of charcoal for cooking increased by up to 15%. (Source: The Role of Taxes and Subsidies in the Clean Cooking Transition, Das et al, 2022).

The Ghana Government is implementing the Renewable Energy Master Plan (REMP). The plan runs from 2019 to 2030, and it intends to promote the development of local renewable energy resources for sustainable economic growth, to contribute to improved social outcomes, and to reduce adverse climate change effects.

REMP aims to increase the use of renewable energy in Ghana from 2019 to 2030 by:

- Increasing the proportion of renewable energy in the national energy generation mix from 42.5 MW in 2015 to 1,363.6 MW (with grid-connected systems totalling 1,094.6 MW)

- Reducing the dependence on biomass as the main fuel for thermal energy applications

- Providing renewable energy-based decentralized electrification options in 1,000 off-grid communities

- Promoting local content and local participation in the renewable energy industry

Ghana has 15 cookstove projects registered in it. These projects have generated 8.4 million carbon credits to date.

Click ‘Read more’ to explore the dashboard.

To CCA’s knowledge, there have been no clean cooking RBF programs in Ghana, nor are there any active RBF programs.